Time to get the

best Yes.

A next generation origination channel enabling Lenders to efficiently access opportunities based on highly targeted risk appetite criteria.

sign up for free sign up for free

Efficient Origination

Receive deals digitally, with complete and analysed data straight to your own lending platform. Significant cost savings are delivered in seeing only qualified transactions, data capture, and rework minimisation

Risk Models

Lending Advisor uses advanced probability of default (PD) risk models to give borrowers an idea of their relative risk and return. Lenders can also apply their own PD (or Loss Given Default) models with data delivered via an API for real time calculation.

Risk Appetite

Only see deals that match your organisational risk appetite. This can be specified at highly granular levels across a range of criteria like segment, risk (PD and LGD), size, and industry.

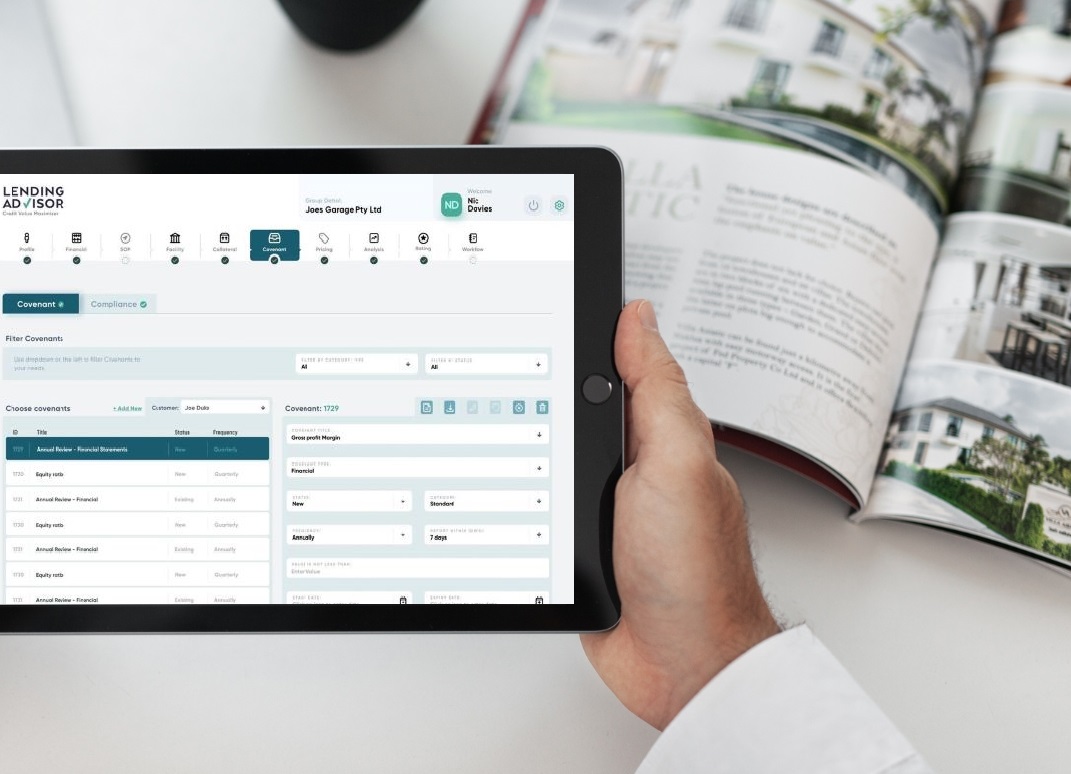

Ongoing Compliance

Lending Advisor includes an ability to manage ongoing information requirements around terms and conditions or covenant compliance, continuing the platforms’ value of brining efficiency to your lending business and delivering an easier, more engaging experience for borrowers.

complete commercial origination capability

Borrowers and Brokers will have access to the tools needed for segment specific credit submissions to be prepared with the complete data set and analytic tools lenders apply in their own businesses

For who?

Check out some use cases

get your best yes. now.

Stronger lending relationships are built when both borrowers and lenders are on the same page about risk and return. Lending Advisor helps lenders build portfolios and work with the best clients.

sign up now sign up now