same technology used by leading banks…

Lending Advisor is bringing the same technology used by leading banks directly to borrowers, enabling better outcomes for all.

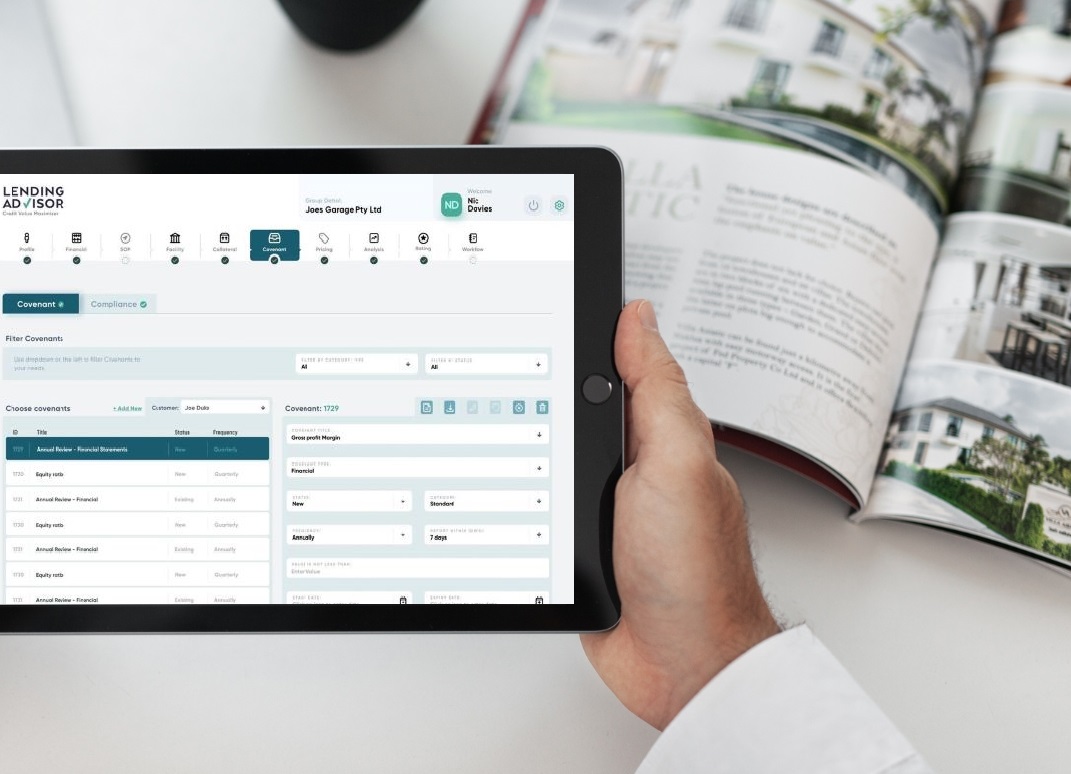

By leveraging the latest in AI and big data, together with our ability to deploy advanced systems used only by the world’s most sophisticated financial institutions until now, Lending Advisor transforms the way larger businesses and their funders interact for both origination and ongoing review and compliance.

Lending Advisor was founded by a group of bankers along with technologists from the fintech industry who saw the limited impact of recent industry innovations on the middle and corporate lending markets.

new business model for driving efficiency

There is a proliferation of tools and services for consumers and simple SME lending needs – but as soon as even a small SME borrowing need evolves past the simple one facility for one entity requirement and includes multiple products, with multiple pieces of collateral and multiple entities in a borrowing group, there was little innovation.

For large corporate lending, the process to manage a lender beauty parade, manage covenant compliance, and amend facilities is still virtually unchanged.

Our combined experience in banking and technology enables Lending Advisor to bring together technology from big lender suppliers, along with the data sources and services used by lenders now and increasingly with open banking innovation, to create a new business model for driving efficiency at all steps of the credit process.

get your best yes. now.

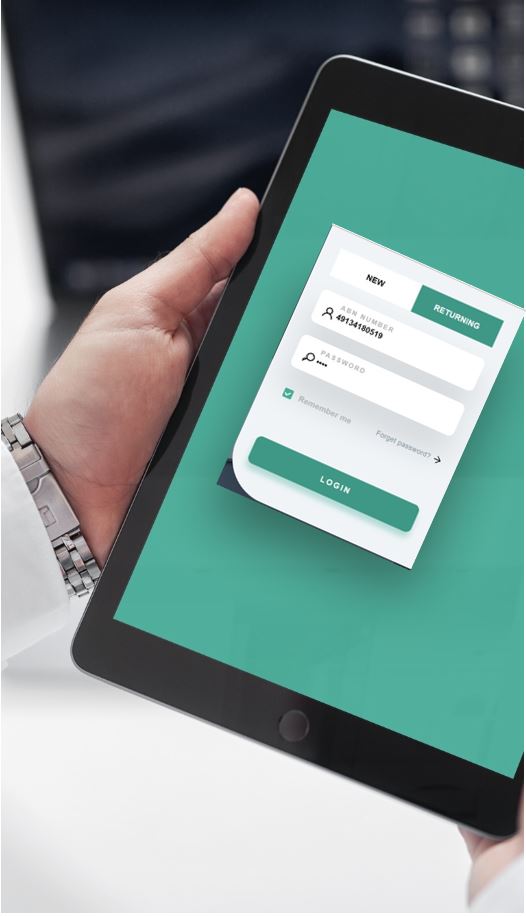

Take control of your lending relationships by being better informed about your risk and return profile. The Lending Advisor platform has been built to bank standards across both operations and data security.

sign up now sign up now