Time to get the

best Yes.

sign up for free sign up for freeSeeking finance, or time for annual review? Use bank standard technology to get the Best Yes.

Best Yes is the fastest with the best terms at the best rate.

Know your risk.

Use bank standard risk models and measures to understand your default risk and how or if security impacts.

Negotiate better outcomes.

Be as informed as lenders about risk and reward. Assess if your lender, or lenders, are right for you.

Dynamic Optimization.

Market conditions, risk appetites, and valuations change. Annual review time is ideal to check if you are still getting the Best Yes.

Optimal recommendations

Our AI driven engine recommends the best lender or group of lenders for your funding needs, matching based on the advanced risk return metrics they use themselves.

01

You have a business or group of businesses

A business, which can include a group of businesses, comes to Lending Advisor.

Meet Lending Advisor

same technology used by leading banks…

We enable borrowers to use the tools big banks do when making credit decisions. Lending Advisor is a technology driven solution bringing the power of AI, big data and open banking to help borrowers get the Best Yes.

02

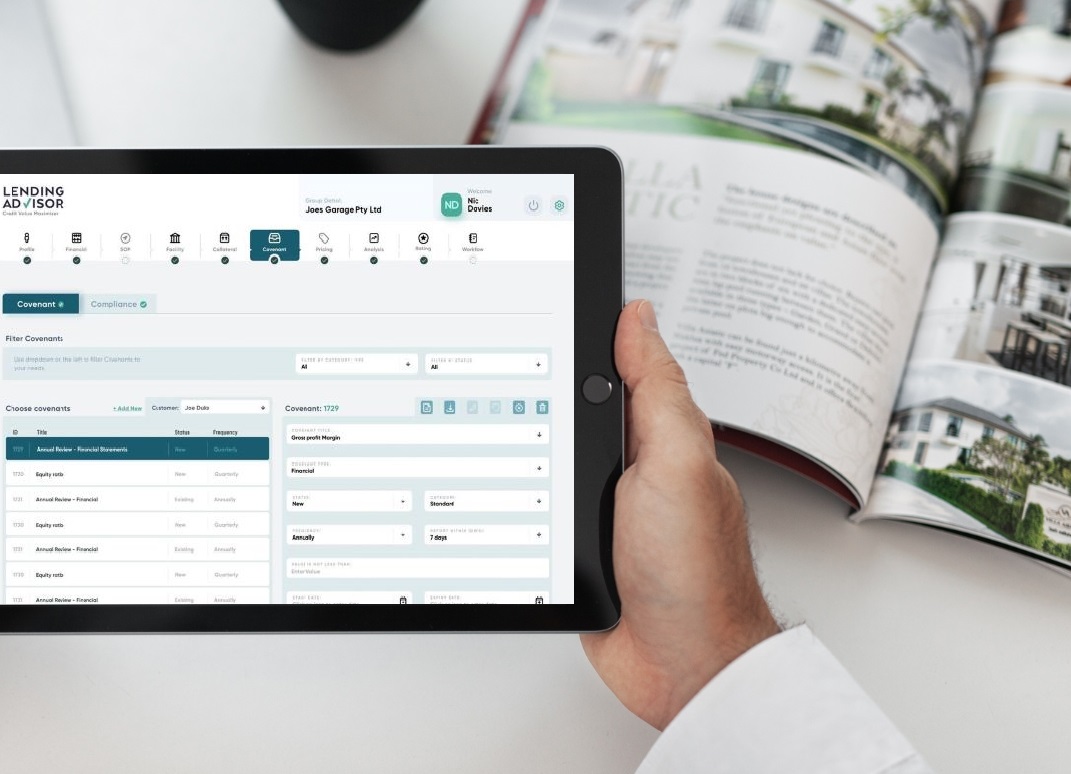

Welcome to Lending Advisor

Enter some data about your funding needs, and some information about your business.

sign up for free sign up for free

03

Lending Advisor then uses specialised Data Sources

Lending Advisor then uses Open Banking, AI, Credit Bureau and specialised Data Sources to enrich information

04

View the application

You can now see how a bank would view the application and understand the relationships between risk, collateral, pricing and terms

05

Best Lenders

Lending Advisor will give recommendations on one or more lenders that best suit your unique characteristics and enable you to authorise and track digital lending submissions.

06

Ongoing Optimisation

Markets are dynamic. Lending Advisor can help you manage the ongoing annual review and covenant compliance requirements to ensure you always get the Best Yes.

sign up now sign up nowFor who?

Check out some use cases

get your best yes. now.

Take control of your lending relationships by being better informed about your risk and return profile. The Lending Advisor platform has been built to bank standards across both operations and data security.

sign up now sign up now